Exclusive: The Art of Trump's Private Equity Deal

President Trump in a matter of months turned from a private equity critic to champion and much of that has come because of a deal involving AI, sources told JOBs.

Back in February when Trump was threatening to end one of private equity’s big tax loopholes, the treatment of carried interest, leading private equity moguls and their lobbyists told the White House they would rather work out an investment plan to boost US energy dominance – an important goal for the President, insiders with direct knowledge of the situation told me at the time.

The idea was of a grand bargain and would culminate with a press conference that included Trump and the head of a private equity firm committing to AI infrastructure, sources told me then.

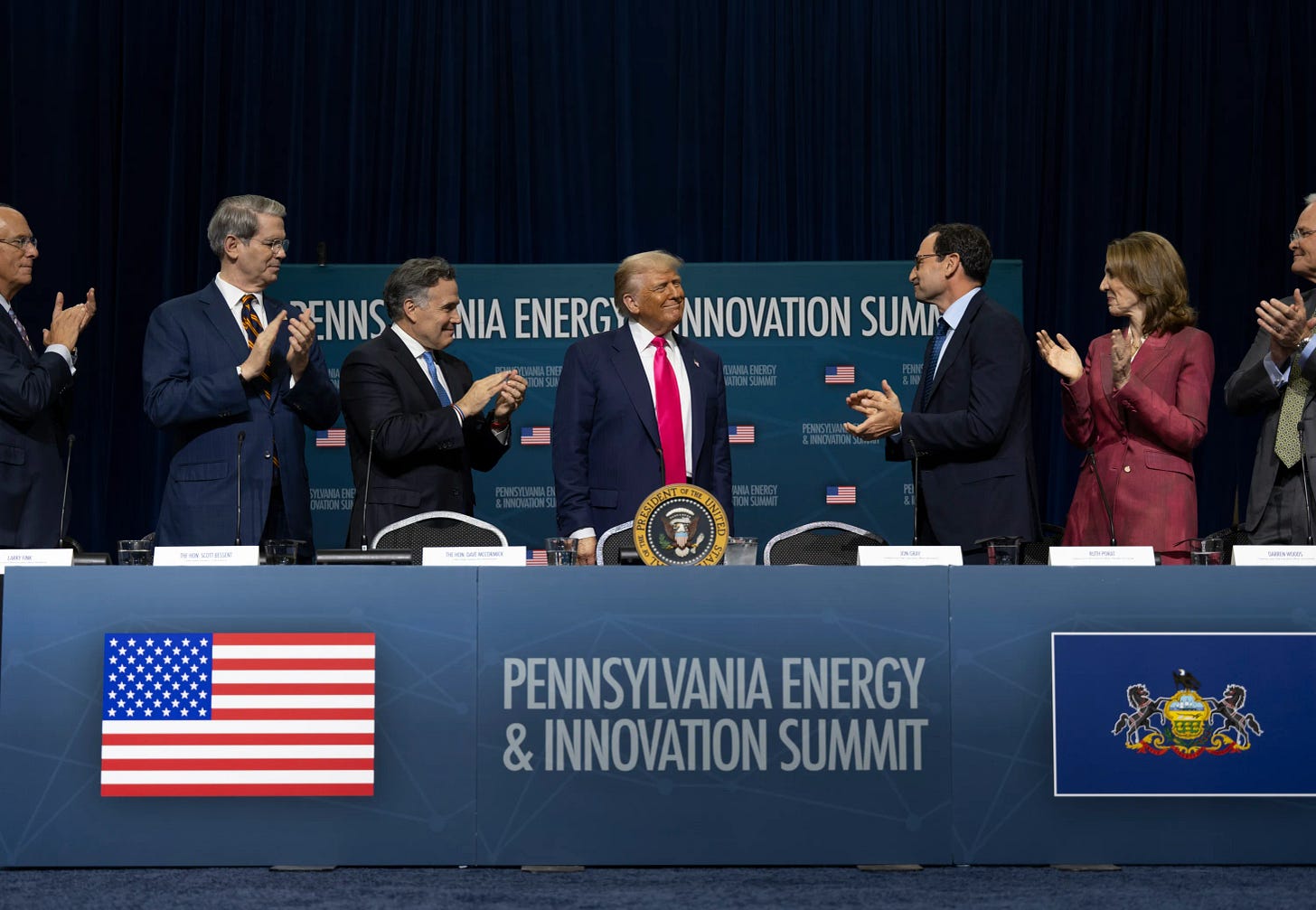

Blackstone Group COO Jonahtan Gray on July 15 sat next to Trump announcing a commitment to invest over $25 billion to support the build out of Pennsylvania’s digital and energy infrastructure. The firm said it was forming a joint venture with utility PPL to invest in new natural gas power generation facilities to provide electricity for AI.

“We believe this new technology [AI] can lead to a manufacturing renaissance in the US,” Gray said. “Generating electrons will spur economic activity and employment growth right here in Pennsylvania.”

Recently Trump has showered the industry with one giant favor after another.

Trump on July 4 signed his Big Beautiful Budget Bill into law. The government kept carried interest the same helping to preserve private equity wealth. What's more the bill increased the deduction on interest payments that can be used by all companies but disproportionately benefits private equity.

Trump reportedly too is set by executive order to announce guidance for the Labor Department and SEC that would make it much easier for private equity firms to raise money from defined benefit plans (401-Ks) for the first time. What 401-K contributors should know is discussed in the following video.

“Despite multiple suggestions from various sources in the months and weeks leading up to the passage [of the Bill] hinting at possible changes to the taxation of carried interest, the [Bill] does not contain any provisions changing the current law,” law firm Ballard Spahr said. “This is welcomed news to fund sponsors.”

“I think private equity firms are incredibly relieved,” a DC source close to the situation said.

During the budget negotiations, Blackstone was working on its AI investment while Congress was hammering out details simultaneously, the DC source said.

“I don’t think it was a deliberate quid pro-quo,” the DC source said but it made Trump amenable to changing his mind.

“The only special interest guiding President Trump’s decision-making is the best interest of the American people,” White House Spokesman Kush Desai told JOBs. “Industry titans ranging from NVIDIA to Apple to Merck have made trillions in historic investment commitments because of their confidence in President Trump and his economic agenda – including energy abundance.”

Blackstone declined comment.

Private equity firms pay a 23.8% capital gains tax rate on profits earned when they exit businesses through a sale or an IPO. Typically, they make a 20% cut, or carried interest, from fund profits. That’s rather than the top rate for ordinary income of 40.8%.

And those aren't the only source of private equity's profits. These firms charge enormous fees to investors and often charge the thousands of companies they own as a kind of salary more than covering their costs, so profits should arguably be treated as ordinary income. That’s the carried interest loophole.

If private equity paid the top 40.8% tax rate on profits instead, the U.S. would raise $13 billion over 10 years, according to the Congressional Budget Office.

“I think you could have easily seen ending carried interest as a way to help pay for reducing taxes on tips,” the DC source said, as the reduction helps the working class while eliminating carried interest essentially impacts billionaires.

The private equity industry’s American Investment Council lobbying group says ending carried interest would hurt long-term investment that creates jobs and that private equity builds businesses in communities across America.

Private equity firms globally had $1.2 trillion to spend as of the end of 2024, according to Bain & Co., and own US businesses employing nearly 10% of the non-government workforce.

More and more has come out over the past decade about the harm private equity does to businesses, their workers, customers and communities where they operate. Several recent books have chronicled the impact like Gretchen Morgenson’s These Are the Plunderers and Megan Greenwell’s Bad Company. I wrote a book in 2009 called the Buyout of America warning about their destructive practices when they were just becoming the behemoths they are today. Because they buy companies by having the companies they acquire take on big loans, private equity firms have a reputation for cutting costs at their companies by laying off more workers than competitors, raising prices and reducing customer service.

Democrats including President Obama and President Biden for years have called for the end of carried interest and done little so Trump is not setting a precedent.

Trump during his first term did limit the carried interest tax break for when firms held companies only for three years or longer.

Private equity firms have been jumping on the AI bandwagon for months so a deal in which private equity firms offered investment in AI data centers to keep carried interest the same would not have been much of a sacrifice, a skeptic said.

“I think they are rebranding something they were already doing,” Jim Baker, executive director of the Private Equity Stakeholder advocacy group said.

The Blackstone Group in 2024 paid $16.1 billion for AirTrunk, a data center operator. The firm in January also agreed to buy the Potomac Energy Center gas plant in Virginia specifically to power data centers.

“As a country, we face the prospect of having to double our power grid’s capacity over the next 12 to 13 years to keep up,” Blackstone said in an Oct. 31, 2024 report.

KKR and Energy Capital Partners in October too announced a $50 billion strategic partnership to accelerate the development of data center and power generation for the expansion of artificial intelligence.